A Complete Guide: TradeStation vs. Interactive Brokers

Nov 04, 2023 By Triston Martin

Introduction

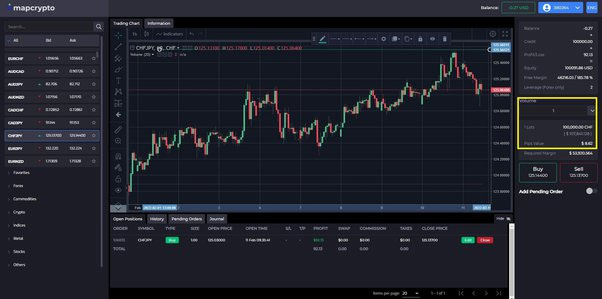

Compared to Interactive Brokers. Which TradeStation solution is the greatest to use for your money? We will compare and contrast the benefits and drawbacks of Interactive Brokers and TradeStation today. Both are the top options for the most committed and knowledgeable traders worldwide. Customers of Interactive Brokers Trader Workstation (TWS) and TradeStation can get top-notch charts and analysis through their respective products, TradeStation 10 and TWS, respectively. Both businesses offer enormous price and rate advantages for individuals who frequently trade in higher volumes, and unlike other sizes, they may be used with all online brokerage accounts.

However, Interactive Brokers and TradeStation are each working to improve their processes to serve Mainstreet investors better. Although many think they are both constructed of the same materials, they each have unique benefits and drawbacks. To help potential investors better understand which broker would be the best for their needs, we will attempt to simplify the alternatives for both solutions. Here we will be comparing TradeStation vs. Interactive Brokers.

TradeStation

Online brokers are available from TradeStation. The business was founded in 1982 and went under the name Omega Research, Inc., An fantastic platform with reasonable commissions, especially regarding options and penny stocks. The computer and online interfaces of TradeStation are excellent for experienced traders, but its mobile app is not as good as those of rival brokerages with premium features. The business is renowned for its online trading systems enabling customers to create unique trade histories and perform superior technical analysis. TradeStation was purchased in 2011 and joined the Japanese Monex Group. The FINRA and the SEC keep an eye on TradeStation regarding the legislation.

Interactive Brokers

Another participant in the field of online brokerage is Interactive Brokers (IBKR). IBKR was established in 1978. IBKR's trading platform has proven to be one of the best for actively traded traders. Its rise to the top of the heap results from its capacity to meet traders' expectations while also evolving into a fully automated e-trading system. The sophisticated platform and technology enable traders worldwide to do almost 4 million trades daily. For experienced, active traders, Interactive Broker is the finest choice. It distinguishes itself with inexpensive prices, discount rates, and a potent trading platform. New and inexperienced investors, however, could feel intimidated.

TradeStation Vs. Interactive Brokers

Both Interactive Brokers and TradeStation are presumably names you are already familiar with. Our analysis demonstrates that each has a clear advantage over the other.

Features & Services

The primary focus of both platforms is on in-depth analytical tools for market research. They provide various choices and widgets to keep both platforms current. Since TradeStation doesn't provide a fundamental analysis, that is their main difference.

Equities, ETFs, bonds, futures, foreign exchange, and other asset types are available through Interactive Brokers. Interactive Brokers, in particular, allow access to marketplaces in other nations.

The TradeStation offers data on worldwide commerce, while the Market Scanner offers details on the global options and equity markets. This indicates that you can trade your assets in the United States and more than 100 markets worldwide. TradeStation does not offer currency conversion services. Instead, it concentrates on the common asset class, cryptocurrencies, and the IPO.

Margin

Naturally, both of these main trading platforms enable margin trades, but Interactive Brokers is the finest.

Customers who have chosen the IBKR Lite plan pay a flat 4.08 percent for all debt levels. It's not that difficult. Customers of IBKR Pro receive discounted rates ranging from 3.08 percent to 2.08 percent. There are several margin rates for accounts denominated in currencies other than the U.S. dollar.

Since only U.S. dollars are accepted, TradeStation is the sole business with a margin schedule. The tiered system starts at 9.5 percent and goes down to 3.5 percent.

Customer Service

Only working days offer phone or chat support for Interactive Brokers. On the other hand, you can email them for support on the weekends. The bulk of TradeStation's offices is open during business hours. However, the company does not have a support department accessible every day of the week, 24 hours a day.

Customers and prospective clients of Interactive Brokers have access to various customer service methods. Contact Interactive Brokers at any hour of the day via live chat or email, thanks to their round-the-clock email service.

TradeStation offers live online chat assistance, email help, and phone support. TradeStation users have access to help throughout regular business hours, with some restrictions on specific structures like tech support. On Sundays, technical assistance is available.

Conclusion

Most active investors can use Interactive Brokers and TradeStation regardless of their platform. Although novices find using both platform and interface interfaces challenging, the option to customize your experience might be helpful. In the end, the trading options and market analysis tools provided by the two online brokerages are well-liked and appealing. Your decision will be influenced by the money you are willing to pay, the type of account you want, and the features you value the most.

Key Aspects of Personal Liability in Renters Insurance: Complete Guide

If you want to protect your belongings while renting, claim for Renters insurance. Risks can be reduced by learning coverage limits and effective ways of filing insurance claims.

Feb 20, 2024 Susan Kelly

See also: What Cars Are Worth to Insurance Companies?

More than 40 million vehicles are sold each year. Some of the most crucial elements that affect the value of your car when you're trying to sell it are the mileage, interior and exterior conditions, location, model, make, and year. Insurance companies may use actual cash value (ACV) to determine how much to pay a policyholder for an accident or vehicle damage. The ACV is the repair cost less the vehicle's depreciation.

Jan 15, 2024 Susan Kelly

Investing in 3x ETFs Can Be Riskier Than You Think

The chances are excellent that if you've been following the stock market for any time, you've heard of a leveraged exchange-traded fund. A ticker symbol identifies an exchange-traded fund, a collection of equities. Throughout the day, they are purchased and sold at prices that may be higher or lower than their net asset worth.

Nov 23, 2023 Triston Martin

The Benefits and Risks of Investing in Unbanked Businesses and Consumers

Want to know if investing in the unbanked is worth it? Read this article to find out everything related to it!

Oct 16, 2023 Triston Martin

What is a traditional IRA, and how to open one

The content help you know What is a traditional IRA, and how to open one along with all the essential information

Feb 10, 2024 Susan Kelly

What Is a Customer Information File (CIF)?: An Essential Guide

The term "customer information system" refers to a file that stores information about a single customer, such as their account information and basic demographics. When it comes to fully integrated banking software, you can't have it without CIFs. Primarily, they support operational activities that rely on current rather than historical data.

Jan 02, 2024 Triston Martin